The Private Equity Playbook: Why Deal Management Software is Now a Necessity

- Sarah Park

- Oct 28, 2024

- 3 min read

In the wake of shifting economic forces, private equity (PE) players are adjusting their approach to mergers and acquisitions. While corporate-driven M&A activity in 2024 shows signs of cautious recovery, private equity faces unique challenges, from volatile interest rates to regulatory hurdles. This dynamic is compelling many in the industry to seek out software-driven efficiencies in deal management, with tools like RedlineDCS and its competitors transforming the M&A landscape.

Rising Challenges in Private Equity

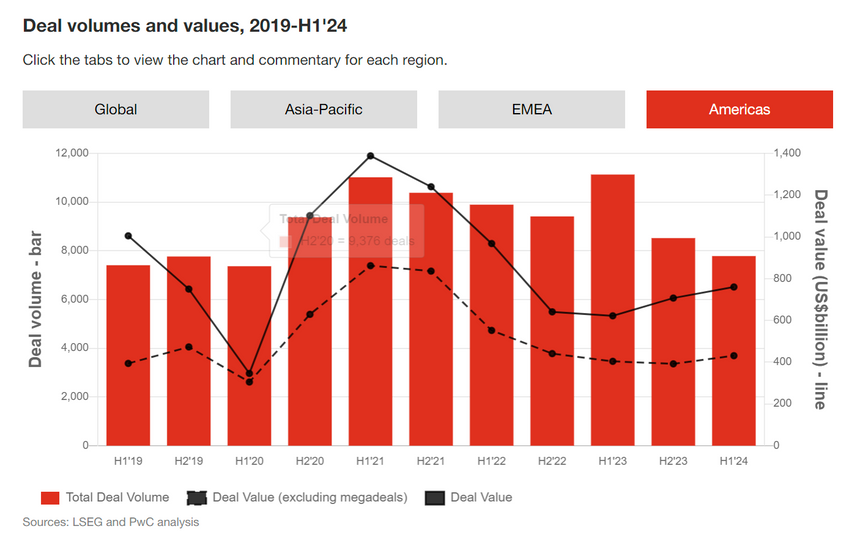

As deal volumes dropped by nearly 25% globally in the first half of 2024, private equity activity declined even more steeply, with some estimates putting the decrease as high as 34% compared to last year. Yet deal value has stayed buoyant, driven by larger transactions in technology and energy sectors, industries favored by private equity groups for their potential growth amid uncertain markets

Adding to the complexities, regulatory scrutiny around megadeals has intensified, especially for cross-border acquisitions. A PwC mid-year report highlighted that the steepest declines in deal volumes were in the Asia-Pacific and European regions due to strict oversight and geopolitical headwinds.

In such an environment where every detail must be documented and every risk tracked, private equity firms are increasingly turning to technology as a means of gaining a competitive advantage in execution.

Navigating the 2025 M&A Landscape: Economic Outlook and Strategic Innovations

With 2025 on the horizon, the M&A market is bracing for both promising opportunities and potential economic challenges. The outlook suggests a nuanced year ahead for deal-making as M&A professionals, driven by optimistic but cautious expectations, prepare for a possible boost in activity alongside ongoing economic adjustments. Many forecasters, including

Deloitte, expect a modest rise in M&A transactions in 2025 as companies seek growth in a cooling economy, particularly within high-performing sectors like technology, healthcare, and green energy. While elevated interest rates may temper the overall deal volume, strategic acquisitions by cash-rich companies, alongside private equity firms adapting to higher financing costs, could fuel selective high-value deals.

Economic headwinds are certainly a factor; however, recent insights suggest potential relief in capital markets that could reinvigorate M&A. Reports from Bain & Company and Balch & Bingham LLP indicate that a potential softening of interest rates might lower financing costs, enabling leveraged buyouts to be more feasible for private equity firms and fostering more competition for acquisition targets. As sellers anticipate stronger negotiating power in this environment, valuation gains and creative deal structures—such as earnouts and deferred payments—are likely to become prevalent, especially within lower-middle market transactions where cost sensitivity remains key.

Technology-Driven Solutions Reshape the Landscape in Deal Software

Deal software has become a crucial part of private equity’s toolkit for both improving operational efficiency and ensuring compliance. Tools that enable the centralization and automation of legal, financial, and regulatory tasks are emerging as key differentiators. McKinsey reports that AI-powered document analysis tools can cut due diligence time in half, allowing firms to allocate more resources to high-level strategic planning and less to administrative tasks

Platforms like RedlineDCS offer specific features that align well with private equity’s workflow needs. For instance, managing NDA campaigns and maintaining virtual data rooms (VDRs) throughout the life of a deal is essential in PE, especially when teams are overseeing multiple, complex acquisitions. Competitors like DealRoom and Datasite also cater to these requirements but often lack the comprehensive integration of post-signing functionality that RedlineDCS delivers, which covers everything from diligence to closing in one unified system. This end-to-end approach has become essential in today’s climate, where the margin for error is shrinking.

Why the Right Software Matters in PE

The stakes are high for private equity firms, which rely on the speed and efficiency of their deal processes to deliver returns. High interest rates have made it costly to keep deals on hold, and geopolitical disruptions mean that delays can be the difference between a lucrative acquisition and a costly misstep. As such, streamlined, compliant deal management is critical to staying competitive.

For firms handling multiple live deals across regions with unique regulatory demands, RedlineDCS’s automated workflows and NDA management capabilities offer significant time and cost advantages. The platform enables seamless transitions from diligence to signing and closing, reducing handoffs that can introduce errors or slow progress. By facilitating compliance from a single, secure platform, RedlineDCS distinguishes itself from competitors, allowing private equity firms to focus on what they do best: acquiring and scaling high-potential assets.

In this increasingly competitive market, private equity firms need more than traditional tools—they need technology that propels their deals forward efficiently and reliably.

Written by Sarah Park, a guest writer and fan of Harry Potter.

Comments